- 1 What is a Maestro Card?

- 1.1 The Importance of Online Security

- 1.1.1 The Growing Threat of Online Fraud

- 1.1.2 The Need for Vigilance

- 1.1.3 Tips for Maximizing Security with Maestro Debit Cards by The Techie Find

- 1.1.4 #1 Activate Enhanced Security Features

- 1.1.5 #2 Keep Your Card Information Confidential

- 1.1.6 #3 Use Secure Websites

- 1.1.7 #4 Regularly Monitor Your Account

- 1.1.8 #5 Employ Virtual Card Numbers

- 1.1.9 #6 Safeguard Against Phishing

- 1.2 Safe Practices for Mobile and App Transactions

- 1.3 Bottom Line

- 1.4 FAQs

- 1.1 The Importance of Online Security

What is a Maestro Card?

In our digital age, safeguarding your financial assets is crucial. Debit cards have revolutionized financial transactions, offering seamless cashless payments. Maestro Debit Cards, known for their global reliability, are prevalent. This guide equips you with essential knowledge and practices to enhance the security of your Maestro Debit Card in online transactions. Understanding its basics and intricacies is the initial stride in protecting your financial well-being in the digital world.

A Maestro Card, issued by financial institutions, grants direct access to your checking or savings account for purchases, ATM withdrawals, and various financial transactions. Unlike credit cards that involve borrowing, a debit card lets you spend what’s in your linked bank account. Maestro, a subsidiary of Mastercard, enjoys a prominent position in the global debit card market due to its widespread acceptance. Comprehending the inner workings of Maestro Card is essential for securing your online transactions effectively and making informed financial decisions.

The Importance of Online Security

In today’s interconnected world, the significance of online security, especially for Maestro’s recommended betting venues, cannot be overstated. With the digital landscape evolving unprecedentedly, the convenience of online transactions and interactions comes hand in hand with various security threats. It’s essential to understand and prioritize online security.

The Growing Threat of Online Fraud

One of the most pressing concerns in online security, particularly for betting sites that accept Maestro, is the relentless growth of online fraud. Cybercriminals are becoming increasingly sophisticated, employing many tactics to compromise personal and financial information. Phishing attacks, malware, data breaches, and identity theft have become commonplace, affecting individuals, businesses, and organizations worldwide.

The financial ramifications of falling victim to such fraudulent activities on these betting sites can be severe, leading to monetary losses and a potentially irreparable breach of trust.

The Need for Vigilance

Given the rising threat of online fraud, vulnerability is the watchword for individuals and businesses. Adopting a proactive stance in safeguarding personal and financial data is imperative. It involves understanding the risks and taking concrete measures to mitigate them. Vigilance encompasses regular account monitoring, strong and unique passwords, enabling two-factor authentication, and staying informed about the latest security threats and best practices.

Tips for Maximizing Security with Maestro Debit Cards by The Techie Find

In a digital era where transactions are the norm, ensuring the security of your Maestro Debit Card is paramount. Implementing these crucial security measures can significantly enhance your protection against potential threats.

#1 Activate Enhanced Security Features

Two-Factor Authentication

To open 2FA adds extra protection of security. When you make a transaction, you need your card and a secondary code sent to your registered device. It minimizes the unauthorized access to your account.

Biometric Authentication

Many Maestro Debit Cards now support biometric authentication, such as fingerprint or facial recognition. These unique biological markers provide an additional shield against unauthorized use.

Transaction Notifications

Setting up transaction notifications on your mobile device or email can alert you to any activity on your card in real-time. This proactive approach detects and reports suspicious transactions promptly.

#2 Keep Your Card Information Confidential

Your Personal Identification Number (PIN) is like a digital key to your funds. It should never be shared, written down, or stored on your device. Memorize it and avoid using easily guessable numbers.

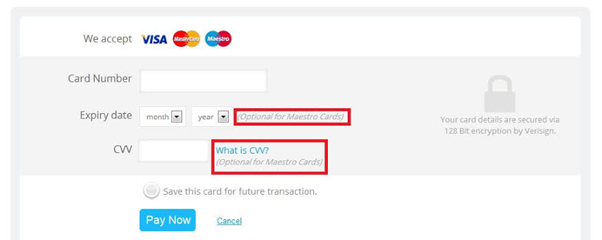

Safeguarding CVV Codes

The Card Verification Value (CVV) on the back of your card is a crucial security element. Please protect it from prying eyes and never share it online or over the phone.

Avoiding Card Photos on Social Media

Sharing pictures of your Maestro Debit Card on social media may seem harmless, but it can give malicious individuals essential card details. Avoid this practice to maintain your card’s security.

#3 Use Secure Websites

Checking for HTTPS and Padlock Icon

When making online transactions, ensure the website’s URL starts with “https://” and look for the padlock icon in the address bar. It indicates that the connection is secure and encrypted, reducing the risk of data interception.

Verifying Merchant Reputation

- Research the merchant’s reputation before entering your card details.

- Stick to well-known and reputable websites, particularly when making online purchases.

- Avoid deals that seem too good to be true, as they might be fraudulent.

#4 Regularly Monitor Your Account

Frequent Statement Reviews

Regularly reviewing your bank statements is a fundamental habit of promptly detecting unusual or unauthorized transactions. The sooner you identify irregularities, the faster you can take action to rectify them.

Setting Up Account Alerts

Numerous banks provide account alert systems that inform when certain account activity occurs. You can set alerts for large transactions, low balances, or unusual. These alerts serve as an early warning system against potential fraud.

#5 Employ Virtual Card Numbers

Understanding Virtual Cards

Virtual card numbers are temporary and randomly generated card details that can used for online purchases. These numbers are separate from your physical card and can be powerful to protect your primary card details.

How to Generate and Use Them

Contact your bank to learn how to generate virtual card numbers. You can typically set spending limits and expiry dates for added security. When shopping online, use these virtual numbers instead of your physical card, reducing the risk of exposing your primary card details.

#6 Safeguard Against Phishing

Identifying Phishing Emails

Phishing emails often attempt to trick recipients into revealing personal information or clicking malicious links. Be wary of emails you didn’t ask for, especially ones that ask for private information. Look for spelling errors and unusual sender addresses, and verify the sender’s legitimacy.

Reporting Suspicious Messages

If you receive an email or message, promptly report it to your bank and appropriate authorities. Reporting helps prevent further attacks and can protect other potential victims.

Safe Practices for Mobile and App Transactions

In an age where mobile devices and apps are integral to our daily lives, adopting secure practices is crucial to safeguarding your financial transactions and personal data. Here are guidelines to ensure your safety when using Maestro Debit Cards for mobile and app-based transactions:

Use Official Banking Apps by The Techie Find

Downloading from Official App Stores

When accessing your bank accounts via a mobile app, always download them from the Google Play Store or Apple App Store, recognized app marketplaces. It ensures that you get a legitimate and secure app version.

Checking App Permissions

Review the permissions it requests before installing a banking app. Make sure the app only asks for access to relevant features and data. If an app demands unnecessary permissions, it could be a red flag.

Protect Your Mobile Device

Using Strong Device Locks

Set strong, unique passwords, PINs, or biometric locks for your mobile device. It provides an initial layer of defense in case your phone is lost or stolen.

Enabling Remote Wipe Features

Activate the remote wipe feature on your device. It allows you to erase all data on your phone remotely if lost or stolen, preventing unauthorized access to your personal information.

Secure Your Wi-Fi Connections

Avoiding Public Wi-Fi for Sensitive Transactions

Public Wi-Fi networks are often less secure. Avoid conducting sensitive transactions or accessing your bank accounts when connected to public Wi-Fi. Wait until you’re on a trusted and private network.

Using VPNs for Extra Protection

To add an extra layer of security. A VPN encrypts your internet connection, making it significantly harder for malicious actors to intercept your data.

Encountering unauthorized transactions on your Maestro Debit Card can be distressing, but knowing the proper steps to take can minimize the damage and protect your financial assets.

Contact Your Bank Immediately

When you detect an unauthorized transaction, contacting your bank is crucial. Please report the issue, whether it’s a stolen card or suspicious activity. Your bank can freeze your card, preventing further unauthorized transactions.

File a Dispute

To discover an unauthorized charge on your account, file a dispute with your bank. Provide all relevant details and documentation about the transaction. Banks often have dispute resolution processes to investigate and resolve such issues.

Keep Records of Communications

Document all interactions with your bank, including phone calls and emails. Request written confirmation of actions taken by the bank. This documentation can be invaluable in case of any discrepancies or disputes.

Bottom Line

Safeguarding your Maestro Debit Card in the digital realm hinges on critical practices such as activating enhanced security features, maintaining confidentiality, using secure websites, and practicing vigilance during mobile and app transactions. Additionally, using virtual card numbers, protection against phishing, and device security contribute to a comprehensive defense strategy.

You can swiftly detect and report unauthorized transactions by actively monitoring your account. In a world where online security is imperative, ongoing vigilance and education are your best allies in protecting your financial assets and personal information.

FAQs

Which betting sites accept Maestro for online gambling?

Popular legal betting sites like Bet365, 888Sport, BetVictor, and William Hill accept Maestro for secure online gambling, offering users convenience and reliable payment options.

What alternative payment options are available for betting if I can’t use Maestro?

If Maestro isn’t an option, consider alternatives like Bitcoin, PayPal, Mastercard, Boku, Neteller, Skrill, or Litecoin for betting transactions.

Why is Maestro popular among online bettors for safety on betting sites?

Maestro’s popularity stems from its strong safety assurances, providing online bettors with confidence and security when placing bets.